Note: The following e-newsletter was sent to Sen. Padden’s subscribers July 2, 2024. To subscribe to Sen. Padden’s newsletter, click here.

Dear friends and neighbors,

This Thursday, people throughout the U.S. will celebrate Independence Day – America’s birthday. It was on July 4, 1776, when the 13 American colonies formally broke away from British rule and declared that they had become a new nation: the United States of America. (Seven years later, on September 3, 1783, the U.S. and Great Britain signed the Treaty of Paris, which officially ended the American Revolution and saw Great Britain recognize the U.S. as a sovereign nation.)

As some history buffs know, the Continental Congress actually voted for independence on July 2, 1776. After several members of the Continental Congress spent two days drafting a Declaration of Independence, the Congress approved it two days later, which is why we celebrate Independence Day on July 4.

July 4 fireworks appear over the Capitol in Olympia.

Throughout our nation’s 248 years of existence, we have experienced great triumphs and tragedies, and other highs and lows. While America continues to change in different ways (some good and some bad), we remain united by constant ideals – our love of freedom and liberty, the blending of new American citizens, and a desire to make our country even better – “a more perfect union.”

For many people, July 4 means food and fireworks. As we enjoy gathering with family and friends on the Fourth, let’s also remember why we celebrate Independence Day and why it matters. Happy birthday, America!

If you have questions about how to participate in state government this year or thoughts to share on anything in this e-newsletter, please give me a call or send me an email.

Thank you, as always, for the honor of representing you in Olympia!

Best Regards,

Senator Mike Padden

Pollinator-habitat workshop is a success

After weeks of planning, a pollinator-habitat workshop co-hosted by my office and the Spokane Conservation District was held June 25 at the conservation district’s headquarters.

Over 30 people attended the free event, including several who work in the landscaping or building-construction industries.

Special thanks to Spokane Conservation District Director Vicki Carter for emceeing and helping plan this event. Another big thank-you goes to the presenters at the workshop, including Katie Buckley of the state Department of Agriculture; Hannah Walker of Spokane Scape; Cathy Spokas, the city of Spokane’s landscaper; Beth Mort of Zinnia Designs; and Aubrey Hoxie of the U.S. Department of Agriculture’s Natural Resources Conservation Services.

Finally, I thank Julia Costello for attending the workshop. Julia deserves credit for asking me to sponsor legislation to enhance pollinator habitat in Washington. The result was Senate Bill 5934, which was approved by the Legislature and Governor Inslee this year and is now state law.

There is talk of hosting other pollinator-habitat workshops later this year. If such events are scheduled, information will be provided in a future e-newsletter.

State revenue projection declining

The state Economic and Revenue Forecast Council last Wednesday adopted a second-quarter forecast that shows a $666 million revenue decline through the next two budget cycles: a drop of $477 million for the 2023-25 fiscal biennium and $189 million for the 2025-27 biennium. The decline was due mostly to a nosedive in the amount of revenue collected through the state’s tax on capital-gains income.

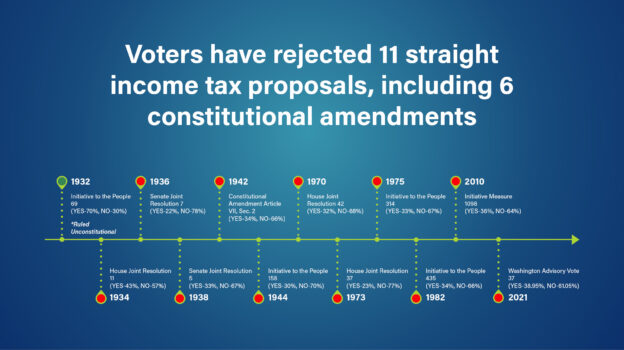

My colleague, Senator Lynda Wilson, who is Republican leader of the Senate Ways and Means Committee and is current chair of the Economic and Revenue Forecast Council, issued a statement last week in which she expressed concerned that the drop-off in income-tax revenue may prompt an effort from legislative Democrats to expand this tax.

Here is Senator Wilson’s statement:

“When we adopted the year’s first-quarter forecast in February, the state’s chief economist warned us to expect slow economic growth – but the economy is not to blame for this predicted drop in revenue. The change in this quarter’s forecast goes hand-in-hand with a sharp decline in the state’s capital-gains tax collections.

“In its first year the capital-gains tax took in about $800 million; here in year two the collections are on track to total about half that much. This is exactly the kind of volatility I and others predicted when the majority Democrats adopted the capital-gains tax.

“When a tax fails to bring in the anticipated level of revenue, it’s almost inevitable that someone will want to cast the net wider and capture more money. Our Democratic colleagues already proposed that idea, and we should expect they will do so again.

“The thousands of Washingtonians already subject to the capital-gains tax include people who have spent years building a business, then sell it to retire. Next thing you know, someone will suggest adding home sales to the list of things covered by the capital-gains tax, and that would hit far more people.

“I’ve said it before: The capital-gains tax doesn’t pay for anything that can’t be funded with other revenue. Our schools and other important things like access to childcare never should have been tied to such a volatile tax. Today’s forecast is proof.”

Our Democratic colleagues will have to fight their natural urge to expand a tax all to satisfy their constant craving for more money from you and other hard-working taxpayers. Republicans will be ready to stand with taxpayers if and when that time comes.

Tax credits for conversion to employee- ownership businesses now available

Last year, the Legislature and the governor approved Senate Bill 5096, which creates the Washington Employee Ownership Program at the Department of Commerce to offer technical support, and other services, to certain businesses considering certain employee-ownership structures. SB 5096 also provides a business-and-occupation tax credit for costs related to converting a qualifying business to an employee-ownership structure.

The state Department of Revenue has made that tax credit available as of yesterday (July 1). Here is DOR’s special notice about the tax credit.

Below is information I recently received from a Department of Commerce official about the upcoming tax credit:

On Monday, July 1st, the WA DOR will go live with the implementation of the tax incentive credit. It will be a very simple process using their existing portal, similar to other tax credits already in place. The DOR team anticipates that the process may take up to 60 days from the submission of the application to DOR issuing the tax credit. I am also enclosing a sample of the notice that businesses will receive via a notification in their portal accounts once the credit is issued.

On our end, our program webpage will also be live on Monday, July 1st. There is a section on this page that will talk about the tax credit and provide links to DOR. DOR will also provide a link to our page. http://www.commerce.wa.gov/eop and http://www.commerce.wa.gov/eop-commission

DOR and Commerce will continue to work together in identifying technical assistance needs for businesses and collaborating on troubleshooting if and when unexpected gaps or questions arise.

Senate Bill 5096 also created a state Employee Ownership Program Commission to oversee the program. I’m honored to be a member of this commission. Other commission members include Joey Nestegard of Schweitzer Engineering Laboratories. The EOP Commission’s next meeting is July 22.

A full-time Legislature? No thanks.

An empty Senate chamber.

The Spokesman-Review last week published an excellent guest editorial by former state legislator Mark Harmsworth that is worth a read. Harmsworth, now with the Washington Policy Center, focused on a recent poll by the left-leaning Northwest Progressive Institute that claimed 59% of likely voters favor seeing Washington’s Legislature meet year-round. As all of you know, under the state constitution our Legislature meets for 105-day sessions in odd-numbered years and for 60-day sessions in even-numbered years, with the option of meeting in special session if necessary.

What the NPI poll failed to point out is the much higher cost that would be associated with a full-time, year-round Legislature.

Harmsworth’s opinion piece noted that on average, the cost to taxpayers for each of our part-time Washington legislators amount to $112,000 annually when salary, per-diem, medical/dental and pension benefits are included. That works out at $123 per hour based on the 60-105 day sessions. Moving to a full-time Legislature could more than triple that salary.

As someone who has served a legislator for 28 years, I think it would be a huge mistake to change from a part-time Legislature to a year-round one. The ideal of “citizen legislators” has been part of Washington since its territorial days. It works, and needs to be preserved.

Article points out sea lions, birds and water temperatures as causes for salmon decline in Snake River

Lower Granite Dam on the Snake River between Clarkston and the Tri-Cities.

As some of you know, there was recent news that the state Department of Ecology and the U.S. Bureau of Reclamation are conducting a study – the Lower Snake River Water Supply Replacement Study – on the potential impacts if Congress decided to breach Washington’s four Lower Snake River dams between Clarkston and the Tri-Cities. DOE and the Bureau of Reclamation held two virtual meetings last week to talk about the study and the dams.

Considering that the Biden administration several months ago struck a secret deal with several tribes and other groups that oppose the Snake River dams, it’s doubtful that the administration will drop its interest in removing the four dams, which provide cheap and clean electric power to our region and offer other benefits, including barge transportation for wheat and other products and goods, irrigation, recreation and flood control.

Chelsea Martin, the government relations and communications coordinator for Modern Electric Water Company, recently wrote an extensive and informative piece about the dams on the Snake and Columbia rivers in which she focuses on the dams’ importance, as well as factors other than the dams that contribute to the decline of the salmon population in the Snake River. You can also read the story here.

“Even if we reach 100% dam passage rates, our most robust mitigation efforts could be totally upended if salmon can’t survive threats,” Chelsea wrote, listing the following as threats to salmon: 1) hostile oceanic conditions, 2) warming rivers, 3) sea lions, 4) 6PPD-quinone, PCBs and other toxic pollution, 5) predatory birds and 6) non-native predatory fish.

Democrats consider ‘retail delivery fee’

As if there aren’t already too many taxes and fees taking money out of our wallets or bank accounts – another fee is being floated.

According to a recent story by KIRO Radio in Seattle, the idea of a “retail delivery fee” was discussed at a joint legislative transportation committee meeting in Vancouver June 18. The proposed fee would apply to taxable retail items delivered by motor vehicles, including packages from Amazon and goods shipped by companies like UPS and FedEx. You can watch TVW’s coverage of the joint transportation committee meeting here.

This part of KIRO Radio’s story was especially noteworthy:

A study conducted by consulting firm CDM Smith examined the potential impact on consumers and businesses. It also analyzed the experiences of Colorado and Minnesota, the only two states with a retail delivery fee. In Colorado, the fee, enacted in 2022, charges 28 cents per delivery, generating $75.9 million in its first year. Minnesota’s fee, implemented in 2023, charges 50 cents for deliveries over $100, raising an estimated $59 million for cities and towns.

For Washington, the consultants evaluated various fee scenarios. If applied universally to all taxable items without exemptions, the fee could generate up to $112 million by 2026 and $160 million by 2030.

Alternatively, if the fee only applies to deliveries exceeding $75 and exempts retailers with less than $1 million in sales, the potential revenue drops to $49 million in 2026 and $70 million in 2030.

The Association of Washington Business and Washington Retail Association expressed concerns about a retail delivery fee, which they called a “doorstep tax.”

“The doorstep tax is a double tax on top of one of the most regressive and highest sales taxes in the country,” they wrote in a report about the proposed fee. “While we acknowledge the need for innovative solutions to address environmental and budget challenges, taxing deliveries is not the answer.”

If this possible fee was to come up for a Senate vote before I retire in early January, I would be a resounding “no.”

Contact us!

If you have a question or concern about state government, please do not hesitate to contact our office. During the interim we are conducting business from our district office in Spokane Valley. We are here to serve you!

Phone: 509-921-2460

Email address: Mike.Padden@leg.wa.gov

PLEASE NOTE: Any email or documents you provide to this office may be subject to disclosure under RCW 42.56. If you would prefer to communicate by phone, please contact Sen. Padden’s Olympia office at (360) 786-7606.

To request public records from Sen. Padden, please contact Randi Stratton, the designated public records officer for the Secretary of the Senate and Senate members.