Note: The following e-newsletter was sent to Sen. Padden’s subscribers February 8, 2024. To subscribe to Sen. Padden’s newsletter, click here.

Dear friends and neighbors,

A few weeks ago, I mentioned that Senate Democrats are considering a bill this session that could dramatically raise your property taxes if enacted.

Unfortunately, this very bad and very expensive proposal is still alive. The Senate Ways and Means Committee on Monday voted to pass Senate Bill 5770, which would triple the allowable growth rate of annual property taxes collected by local governments in Washington. Governments currently may collect an additional 1% annually in property tax, plus any revenues attributable to the value of new construction, without having to seek voter approval. This proposal would change that increase from 1% to 3%. The state Department of Revenue has estimated that the proposed substitute version of SB 5770 would increase taxes by a whopping $7 billion over the next 10 years, with the compounding effect of the increase continuing to escalate over time.

There is talk in the Capitol that Senate Bill 5770 might be brought to the Senate floor as early as later today. If so, I will strongly oppose this very bad and unnecessary bill. Homeowners and landowners are paying enough in property taxes without being put in a position by the Legislature to pay even more.

If you have questions about how to participate in state government this year or thoughts to share on anything in this e-newsletter, please give me a call or send me an email.

Thank you, as always, for the honor of representing you in Olympia!

Best Regards,

Senator Mike Padden

Bill requiring insurance to own guns dies in committee

Every year in Olympia, Democrats sponsor several bills that infringe on law-abiding gun owners in one way or another.

It’s good to report that one of the more outrageous anti-2nd Amendment bills has been stopped this year.

Senate Bill 5963, introduced by 48th District Senator Patty Kuderer of Bellevue, would require gun owners, including renters, to have a home insurance policy simply for owning a firearm.

The NRA provided ample reason why SB 5963 is bad legislation:

Mandating insurance policies will in no way reduce crime and the illicit use of firearms, as criminals and other prohibited persons could never secure coverage. Instead, this legislation would serve as a barrier to those seeking to exercise their rights, including unknown annual costs. SB 5963 could be utilized as a backdoor registration scheme, which would include sensitive personal information on firearm owners, including name, address, phone number and other identifiers. Additionally, given the uncertainty if this type of coverage would even exist, it could put insurance companies in a position of increased pricing on policies based on the types and number of firearms covered. This legislation is not rooted in public safety, but instead provides an additional avenue for the Washington State Legislature to harass and burden law-abiding citizens.

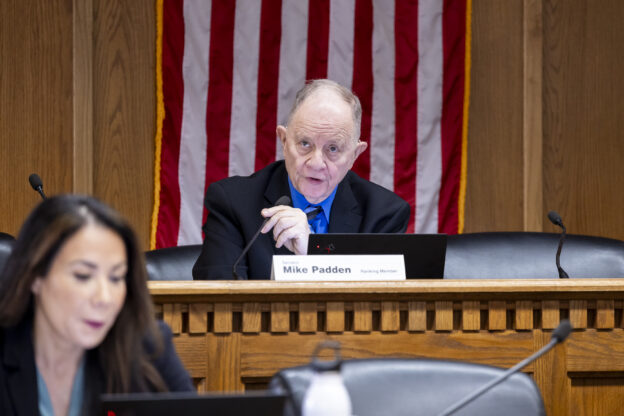

As Republican leader in the Senate Law and Justice Committee, Senator Padden helped lead the successful effort to keep Senate Bill 5963 from being approved by the panel.

For many gun owners, SB 5963 represents yet another Democrat-sponsored bill to make it harder and more expensive to own a gun. Of the nearly 2,100 people who signed up to express their opinion on this measure when it received a public hearing in the Senate Law and Justice Committee on January 29, over 1,300 (62%) opposed it.

Among the many people who testified against SB 5963 was Jeremy Ball, who owns a shooting range in Spokane. You can view and hear Jeremy’s testimony here.

Those testifying against the bill made several worthy arguments:

- This bill will make housing in Washington even less affordable.

- The bill would require an ongoing fee, in the form of insurance, to exercise a constitutional right.

- SB 5963 would not reduce gun crimes because it only addresses accidental discharge.

- If this passes, gun owners will be forced to choose between housing and keeping their firearm.

- Reporting of firearm ownership to insurance companies is akin to a firearm registry.

- The insurance products described in this bill do not exist.

- Citizens will be priced out of gun ownership because of the increased cost of purchasing insurance.

- This bill discriminates against gun owners.

- Impoverished people would suffer the most under this bill due to the increased costs associated with protecting themselves.

- This bill is unnecessary. Firearms account for less than one percent of preventable accidents.

Fortunately, thanks in large part to the vast opposition to SB 5963 during its public hearing, as well as the many calls and emails from gun supporters to key legislators on the Law and Justice Committee, the bill was not brought up for a vote, so it is dead – at least until next year.

However, it would not be surprising if Democrats choose to introduce the same bill in 2025.

Six initiatives to the Legislature still ‘held hostage’ by not receiving public hearings

This poster, featuring Amazon CEO Jeff Bezos and seen on the Capitol campus in Olympia, underscores how the state’s capital-gains tax could force residents to leave Washington.

It’s very disappointing that Democrat leaders in the Senate and House still have not scheduled public hearings on the six initiatives that were sent to the Legislature earlier this session. These measures each received more than 400,000 signatures and collectively over 2.6 million signatures. Here’s what each would do:

- Initiative 2113 deals with police pursuits. It would erase certain requirements that since 2021 have prevented law-enforcement officers from pursuing a suspect unless they think someone has committed certain crimes, including a violent offense or driving while impaired. It has been sent to the Senate Law and Justice Committee for consideration.

- I-2117 would repeal the state’s costly climate policy, called “cap-and-trade” by some but “cap-and-tax” or “cap-and-gouge,” by opponents who note this law has caused gas prices to rise substantially. The climate policy became state law in 2021 and took full effect early last year. It is now in the Senate Environment, Energy and Technology Committee.

- I-2081 would give parents the right to review K-12 instructional materials and require parental notification of school-provided medical services. It has been referred to the Senate Early Learning and K-12 Education Committee.

- I-2109 would repeal the state capital-gains tax that was passed by the Democrat-controlled Legislature in 2021. It is now in the Senate Ways and Means Committee.

- I-2111 would ban any local or state government in our state from imposing an income tax. Like I-2109, this measure is in the Ways and Means Committee.

- I-2124 would allow people to opt out of the mandatory payroll tax for the state-run long-term care program. It is before the Senate Labor and Commerce Committee.

Legislators have three options with initiatives to the Legislature: 1) adopt the initiative as written, in which case it becomes law; 2) refuse to pass it, which would result in the measure automatically being placed on the statewide ballot next fall; 3) propose and approve an alternative initiative, in which case both the original initiative and the alternative would both appear together on the fall statewide ballot.

Another poster found around the Capitol points out how I-2113 would help improve public safety by restoring police pursuits in Washington.

There are rumors that the Democrats might schedule public hearings on three of the initiatives – parental rights (I-2081), banning any income tax (I-2111) and restoring the ability of police to pursue (I-2113). However, if the hearings occur, it would not happen until after the February 13 “floor cutoff” for the Senate to pass bills that originated in our chamber.

Senate passes second Padden bill removing red tape from construction of smaller condominiums

A year ago, the Legislature unanimously approved a bill that I prime-sponsored that helps encourage home ownership in Washington by making it easier to construct smaller condominium buildings.

A similar condo-construction measure that I introduced is advancing this year following its unanimous passage Tuesday. The proposal now goes to the House of Representatives for consideration.

Senate Bill 5792 would exclude buildings with 12 or fewer units that are no more than three stories high from the definition of “multiunit residential building” if one story is utilized for above- or below-ground parking or retail space.

This bill builds on last year’s efforts to have more housing options for Washington’s middle class. Condominiums provide an affordable path to homeownership for first-time homebuyers.

When SB 5792 received a public hearing in the Senate Law and Justice Committee last month, several people testified in favor of it, including Spokane Valley City Council member Rod Higgins, Spokane City Council President Betsy Wilkerson, Greenstone Corporation’s Jim Frank and officials from the Washington Realtors Association and the Building Industry Association of Washington.

The law created by last year’s condo bill, Senate Bill 5058, exempts buildings with 12 or fewer units that are no more than two stories high from the definition of “multiunit residential building.”

Washington has one of the lower homeownership rates in the nation, and both policies can help our state address this problem. These smaller condominiums would still have the same building requirements that a townhouse or single-family house would have.

The combination of that law and this year’s new bill, if it is enacted, should result in more homeownership in the state.

Contact us!

If you have a question or concern about state government, please do not hesitate to contact our office. During the session we are conducting business from our Senate office in Olympia. We are here to serve you!

Phone: (360) 786-7606

Olympia Office: 215 Legislative Modular Building, Olympia, WA 98504-0404

Email address: Mike.Padden@leg.wa.gov

PLEASE NOTE: Any email or documents you provide to this office may be subject to disclosure under RCW 42.56. If you would prefer to communicate by phone, please contact Sen. Padden’s Olympia office at (360) 786-7606.

To request public records from Sen. Padden, please contact Randi Stratton, the designated public records officer for the Secretary of the Senate and Senate members.