The following newsletter was sent to subscribers to Sen. Padden’s Report From Olympia, May 11, 2017. To subscribe to Sen. Padden’s newsletters, click here.

Dear friends and neighbors,

We have reached the midway point of our 30-day overtime session in Olympia, and to all outward appearances it might not look like much is happening. Most of us who serve in the Legislature have returned home to our districts while we wait for negotiators to reach agreement on a budget. There is little news about the progress of these budget talks, but we could be called back to the statehouse at any time. Once an agreement is reached, we will be able to wrap up the loose ends of our session and adjourn for the year.

The biggest challenge we face this year is to come up with a fairer system to finance our public schools. In the Senate, we have come up with a plan that would give everyone the same property-tax rate, and would not increase the overall level of taxation. Meanwhile, our counterparts in the House are insisting on a $3 billion tax increase. Other issues will be dealt with once we return, including reform of the troubled state Department of Corrections, and overturning a state Supreme Court decision that has created immense problems for rural property owners who need to drill household wells in order to develop their land.

While we wait for our budget writers to reach agreement with the House, disquieting news from the state of Connecticut ought to inform our negotiations. A tax scheme rather like the one proposed by Democratic leaders here has caused major problems for the Nutmeg State. The situation in Connecticut shows why tax-the-rich schemes ultimately will backfire, and force tax increases on the rest of us. The likely result here would be to force lawmakers to adopt an income tax, something the voters have told us time and again they don’t want. In this week’s newsletter, I’ll tell you about this misguided effort to bring an income tax to Washington, and what we might be able to learn from Connecticut.

Sen. Mike Padden

Corrections case confirms key conclusion of Senate investigation

A year after a Senate investigation determined pervasive mismanagement at the state Department of Corrections was responsible for the early release of 3,000 violent and dangerous inmates, a new decision by a state board confirms one of our central findings.

The state Personnel Resources Board has overturned the permanent demotion of Dave Dunnington, an information-technology manager who was singled out for blame by investigators hired by the governor’s office. The state board reached the same conclusion we did — the decision to delay a critical software fix was a collective responsibility shared by others in agency management. Dunnington did not unilaterally decide to delay the work, as the governor’s investigators claimed.

This was one of the most tragic cases of mismanagement in the history of Washington state. Two deaths and numerous crimes have been linked to felons who should have been behind bars, and the state likely will pay millions in damages. Understandably the governor’s office was eager to blame mid-level employees, rather than the upper-level managers the governor supervises. The case demonstrates the value of the independent investigation conducted by the Senate Law and Justice Committee, and it should make the case for passage of our Corrections reform bill, which awaits a vote in the House. For more information, click here.

Connecticut’s budget nightmare – could it happen here?

One of the leading ideas offered by House Democrats and Gov. Jay Inslee is a new income tax on capital gains. This is a narrow type of income tax that would target the wealthy. In the Senate, we have argued this tax would quickly lead to an income tax that would be imposed on every taxpayer of the state. Such taxes are particularly vulnerable to downturns. The next time the economy hits a speed bump, lawmakers would be forced to raise hundreds of millions of dollars in a hurry. A broader income tax would be the logical next step.

One of the leading ideas offered by House Democrats and Gov. Jay Inslee is a new income tax on capital gains. This is a narrow type of income tax that would target the wealthy. In the Senate, we have argued this tax would quickly lead to an income tax that would be imposed on every taxpayer of the state. Such taxes are particularly vulnerable to downturns. The next time the economy hits a speed bump, lawmakers would be forced to raise hundreds of millions of dollars in a hurry. A broader income tax would be the logical next step.

The current situation in the state of Connecticut shows this is more than just a theory. Connecticut’s income tax on capital gains is weighted heavily toward its wealthiest taxpayers, just like the proposals offered here by advocates of higher taxes and spending. The problem is that in 2016, Connecticut’s biggest taxpayers held onto their stocks, preferring to ride out the markets in 2017.

Late last month, Connecticut officials announced that tax collections have plummeted. The state now must raise more than $400 million before the end of June, and it faces another $1.4 billion deficit over the next two years. This, in a state with half our population. Connecticut’s General Assembly is scrambling for ways to raise the money, and already Democratic leaders are suggesting increases in their income tax, to be paid by all taxpayers, including the middle class.

The Connecticut case demonstrates the foolishness of expecting taxes on the rich to provide a stable source of funding for our public schools. It also shows how a capital gains tax would back Washington into a corner and set us up for a general income tax. Perhaps the most important lesson from Connecticut is that this is a road we should not travel.

Income tax advocates just won’t give up

Probably the one thing, more than any other, that has prevented the state of Washington from adopting an income tax is a 1933 state Supreme Court decision that held a graduated income tax to be unconstitutional. This has meant the public must vote on a constitutional amendment before such a tax can be imposed. Voters have said no every time the question has appeared on the ballot since 1934.

Tax advocates are convinced the current Supreme Court will overturn its decision if the Legislature were to adopt an income tax and the court is given a chance to rule. This would allow the Legislature to impose an income tax without a vote of the people. The proposed capital gains income tax would provide such a test case. But there is another way a test case might be placed before the court. The Seattle City Council decided last week to pursue a municipal income tax, even though city-wide income taxes are expressly prohibited by state law. A similar effort was defeated in Olympia last year, but another effort was launched this week in the city of Port Townsend.

This flurry of activity demonstrates that an income tax is a very real danger in the state of Washington, putting the brakes on our economic growth and leaving our state at a competitive disadvantage. We must be on our guard against proposals that would lead inexorably to higher taxes that would punish the middle class.

Congratulations to Spokane Youth Sports Awards finalists

The Spokane Sports Commission has announced the finalists for its 2017 Youth Sports Awards. Among the finalists for coach of the year is Alex Schuerman, baseball coach at Mt. Spokane High School. The school’s baseball team is a finalist for male team of the year, and contenders for the female team of the year include the Central Valley High School track team and the Mt. Spokane High School volleyball team. Lexie Hull of the Central Valley basketball team is a finalist for female athlete of the year.

These awards will be presented at the Fox Theater in Spokane June 5, and offer a recognition of youth athletes in our region who exemplify high standards of character, sportsmanship and community service.

Law and Justice Committee passes omnibus crime bill

The Senate Law and Justice Committee meets in Olympia. Pictured are Sens. Lynda Wilson, R-Vancouver, Jan Angel, R-Port Orchard, committee vice chair Steve O’Ban, R-University Place, and chair Mike Padden, R-Spokane Valley.

One of the items that will be on the Legislature’s radar screen when it returns to finish the year’s business is a comprehensive crime bill we passed in the Senate Law and Justice Committee last week. Senate Bill 5934, which I have sponsored, incorporates several proposals that did not pass during our regular session, including higher criminal penalties for sexual offenses against children and for habitual property offenders, and the issuance of two-year identicards for offenders released from prison. Rising property crime is a particular concern in Spokane County, and we look forward to action on this important issue.

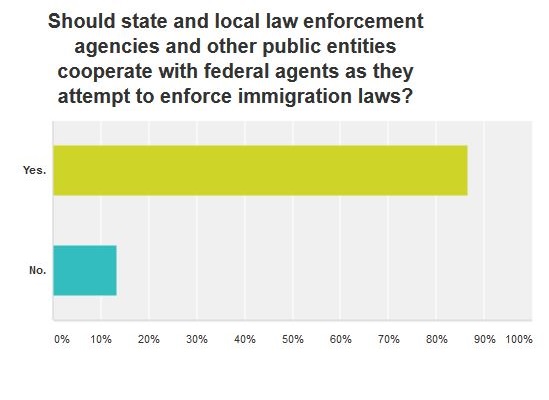

Survey shows support for immigration enforcement

Last week we asked subscribers to this newsletter whether state and local law enforcement officials and other public agencies ought to cooperate with efforts to enforce federal immigration laws. This has been a major issue this year as prominent politicians, including the state’s attorney general, urge public officials to resist. The results show overwhelming support for cooperation with federal enforcement activities. Eighty-eight percent favor cooperation.