The following newsletter was sent to subscribers to Sen. Padden’s newsletter, Jan. 14, 2019. To subscribe to Sen. Padden’s newsletters, click here.

Opening-day ceremonies in the House and Senate mark the start of each legislative session. Above, the Senate opens for business in 2018.

Big tax increases the issue as the 2019 session begins

Dear friends and neighbors,

As the Legislature launches its 2019 session today, you might be tempted to hum that old tune, “I’ve Heard That Song Before.” Fast-growing tax collections are filling the treasury with money, yet some people say it’s still not enough. Once again, the governor is proposing the biggest tax increase the state has ever seen. The income tax is back on the table. And those of us who believe in fiscal responsibility are gearing up for battle.

How many times have we heard this before? The difference is that winning the fight this time will be tougher than ever. I’ll tell you about it in this week’s newsletter.

Our session opens today with ceremonies in the House and Senate, and if all goes according to schedule, we will adjourn in 105 days on April 28. As always, we look forward to serving the people of the 4th Legislative District. If you plan to visit the Capitol anytime over the next three-and-a-half months, we hope you will stop by and see us at 106 Irv Newhouse Building. We are here to serve you.

Sincerely,

Senator Mike Padden

State coffers overflowing, but some say $5 billion isn’t enough

Over the next two years, state tax collections are expected to rise nearly $5 billion, the product of a healthy and growing economy. Some of that growth is due to federal policy, but Washington also can credit previous legislatures for resisting dramatic tax increases. We didn’t put the brakes on economic growth.

Over the next two years, state tax collections are expected to rise nearly $5 billion, the product of a healthy and growing economy. Some of that growth is due to federal policy, but Washington also can credit previous legislatures for resisting dramatic tax increases. We didn’t put the brakes on economic growth.

This wasn’t easy. A fiscally conservative Senate blocked big tax increases for most of the last decade, even as a state Supreme Court decision forced us to plow most new money into the public schools. If we just stick to the plans we made in previous years, we have more than enough to meet the state’s needs without raising taxes.

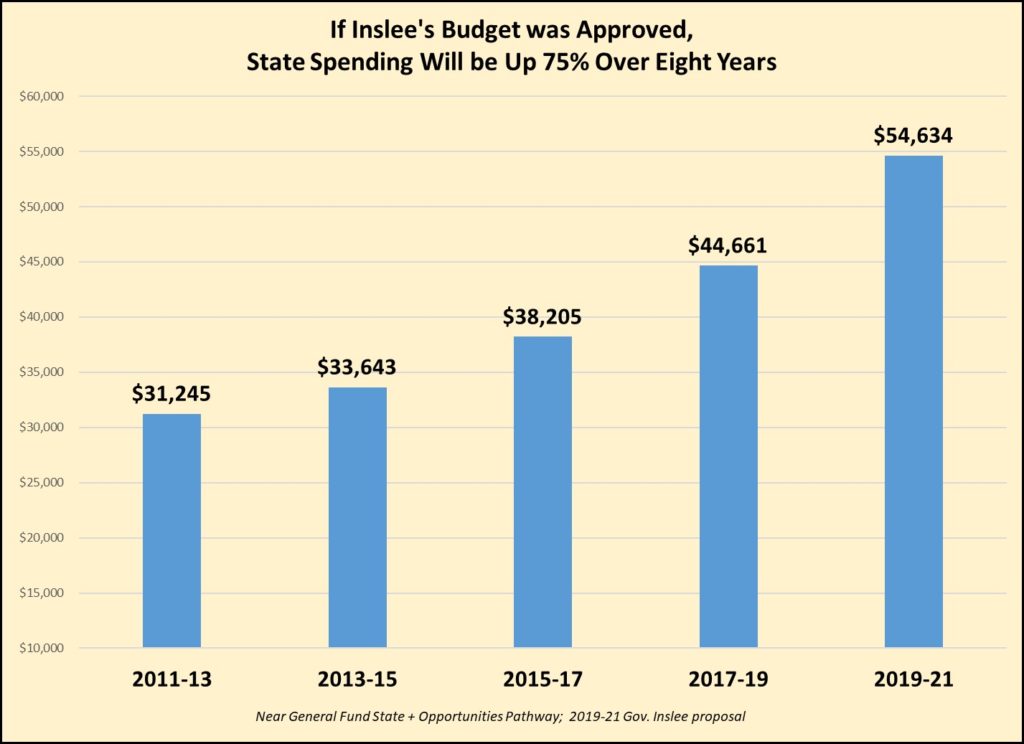

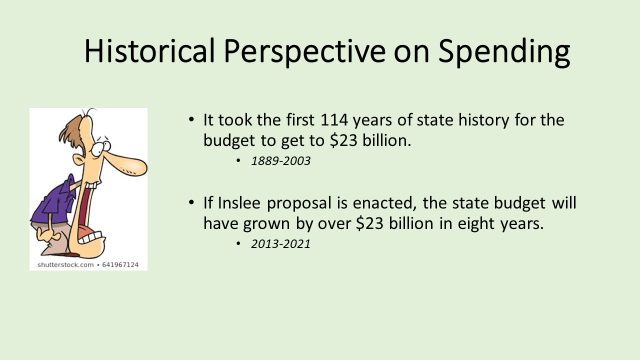

Here’s the problem. Advocates of higher taxes and spending now enjoy majorities in the House and Senate, and they control the governor’s mansion. This is the first time since the Great Recession that they will write the budget. So there is a decade of pent-up demand for higher spending from an army of special-interest groups. This is reflected in the governor’s new budget proposal. He wants a whopping $5 billion increase in spending, on top of the new money we expect to collect.

Think about this way. We will have 9.2 percent more money available to us than the last time we wrote a budget, two years ago. Most of us would consider that healthy. But the governor wants more than double that — an enormous 22.4 percent increase in spending. Even if the Legislature whittles that back just a tad, you can see this could be a tough year for taxpayers.

Will this be the year an income tax sneaks through?

One of the ways the governor proposes raising this money is with a new income tax on capital gains. Never mind the fact that our state constitution forbids most income taxes. The governor and other advocates of higher taxes expect a court challenge, and they are counting on our liberal state Supreme Court to reinterpret the constitution to allow an income tax. This proposed 9-percent tax would have a devastating impact on the tech industry, one of the biggest contributors to our state’s economic prosperity. This is one good way to kill the golden goose.

One of the ways the governor proposes raising this money is with a new income tax on capital gains. Never mind the fact that our state constitution forbids most income taxes. The governor and other advocates of higher taxes expect a court challenge, and they are counting on our liberal state Supreme Court to reinterpret the constitution to allow an income tax. This proposed 9-percent tax would have a devastating impact on the tech industry, one of the biggest contributors to our state’s economic prosperity. This is one good way to kill the golden goose.

What could happen in the future is even worse. Capital gains income taxes are wildly volatile – they would plummet in the next recession. If the state Supreme Court gives the income tax a green light, the Legislature’s obvious next move would be to extend this income tax to the rest of us. The special interests are counting on it.

The governor also wants a 67 percent increase in the tax rate on service businesses – meaning doctors and dentists, accountants, architects, and other professional and technical trades. All of us will feel the impact in the form of higher bills for services. Even movie-ticket prices would go up.

Most of the new spending the governor proposes can hardly be called essential – particularly big salary and benefit increases for public employees. Some things we really need to do, like improving our mental health system, but these can be accomplished without new taxes. Many of us believe there is even room for a tax cut. The Washington Policy Center is advocating a sales-tax decrease; other ideas include a property-tax break and a manufacturing tax incentive. Get set for a wild debate.

4th District priorities include Barker to Harvard project

This year I remain ranking member on the Senate Law and Justice Committee, and I will retain my position on the Early Learning and K-12 Education Committee. But I will be taking on a new assignment as a member of the Transportation Committee. My House seatmates, Reps. Bob McCaslin and Matt Shea, serve on the House Transportation Committee, and this will put us in good position to advocate for Spokane Valley priorities. Our top item this year is the Barker-to-Harvard project – improvements to the Barker and Harvard interchanges, and a new I-90 overpass at Henry Road.

This year I plan to introduce legislation to further discourage driving-under-the-influence, promote condominium development, and reduce regulatory burdens on small daycare facilities. I’ll tell you more about those issues in the weeks ahead.

Hear Sen. Padden on KQNT radio

Last week I appeared on KQNT radio in Spokane to discuss the upcoming legislative session and some of the issues we will be considering – including the Barker-to-Harvard project. You can listen to this interview by clicking below.

Governor’s marijuana pardons raise concerns

Last month the governor announced a plan to pardon those convicted of marijuana-related misdemeanors, allowing records of convictions to be expunged. The governor says this effort is justified by the legalization of marijuana in this state. But such things are never so simple. Under ordinary circumstances, pardons are considered by the state Clemency and Pardons Board, and prosecutors and victims are notified of hearings. At these hearings, we sometimes hear that the conviction was plea-bargained down from a greater offense. Sometimes there are other circumstances that might cause us to keep the conviction on the books.

Under the governor’s new marijuana-pardon process, it does not appear there will be an opportunity for this type of comment from interested parties. Bypassing public input sets a troubling precedent.

Last week I wrote the governor’s office to request an explanation. If we’re going to circumvent the process outlined by law for marijuana convictions, what’s to prevent the law from being ignored for other pardons in the future?

In the News: CV School District’s Jan Frank wins education honors

On Veterans’ Day, it was my pleasure to participate in ceremonies at McDonald Elementary to honor music teacher Jan Frank. She has been named Central Valley School District teacher of the year by American Legion Post 241, of which I am a member, and also has been named the Washington State American Legion Educator of the Year. Frank has taught music at McDonald Elementary for the last 11 years, and her dedication to her craft and her students have earned high regard from her peers. You can read more about this honor in this story from the Spokesman-Review.

Contact us!

With the opening of the 2019 legislative session, we have moved our office to Olympia for the duration. If you have a question or concern about state government, please do not hesitate to contact our office. We are here to serve you!

Phone: (360) 786-7606

Street address: 106 Irv Newhouse Building, Capitol Campus, Olympia, WA 98504

Postal address: PO Box 40404, Olympia, WA 98504

Email address: Mike.Padden@leg.wa.gov

Podcast: Play in new window | Download